The delivery trades have been pretty good, apart from two fucked up stocks namely Borosil Renewables and Cummins (although it seems to be a fundamentally great stock with a healthy dividend yield). These two stocks went down around -10% before which I had to close my positions in order to get back my funds to look for better trades. Although a great strategy, a large share of my portfolio must be allocated for a single trade, which certainly is unhealthy. Even after the drawbacks, I tried backtesting some of the stocks that regularly go beyond 65% delivery volume, and the returns over a period seem promising. In some cases the stock may have generated single-digit returns in a year, or even negative, but the delivery volume strategy has outperformed the aforementioned.

Stocks that were used for the backtest are:

(1) Bharti Airtel:

Entry Condition: Buy @ (Day Opening Price on Day n+1) if (Delivery Volume on Day n >= 65%)

Exit Condition: Sell @ (Day High) or (Next Day High)

[Dubious af, because how the hell is one supposed to know the day high]

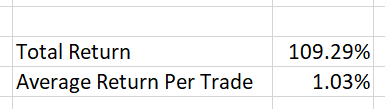

The Backtests; The Rightmost column shows the return generated on every trade from Sep 2, 2022 to Sep 1, 2023

No comments:

Post a Comment