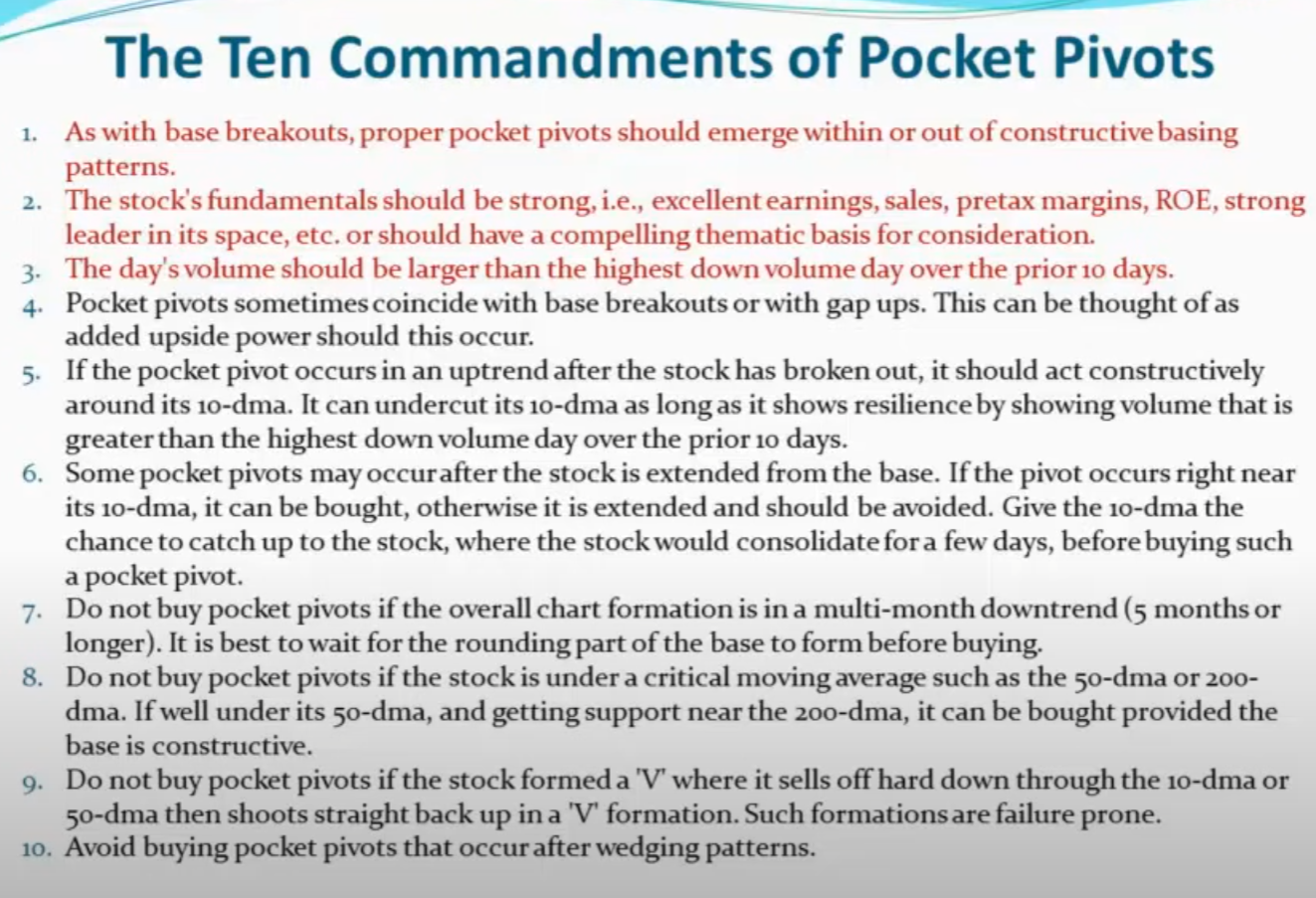

The Ten Commandments of Pocket Pivots

1. As with base breakouts, proper pocket pivots should emerge within or out of constructive basing

patterns.

2. The stock's fundamentals should be strong, i.e., excellent earnings, sales, pretax margins, ROE, strong

leader in its space, etc. or should have a compelling thematic basis for consideration.

3. The day's volume should be larger than the highest down volume day over the prior 10 days.

4. Pocket pivots sometimes coincide with base breakouts or with gap ups. This can be thought of as

added upside power should this occur.

5. If the pocket pivot occurs in an uptrend after the stock has broken out, it should act constructively

around its 10-dma. It can undercut its 10-dma as long as it shows resilience by showing volume that is

greater than the highest down volume day over the prior 10 days.

6. Some pocket pivots may occurafter the stock is extended from the base. If the pivot occurs right near

its 10-dma, it can be bought, otherwise it is extended and should be avoided. Give the 10-dma the

chance to catch up to the stock, where the stock would consolidate for a few days, before buying such

a pocket pivot.

7. Do not buy pocket pivots if the overall chart formation is in a multi-month downtrend (5 months or

longer). It is best to wait for the rounding part of the base to form before buying.

8. Do not buy pocket pivots if the stock is under a critical moving average such as the 50-dma or 200-

dma. If well under its 50-dma, and getting support near the 200-dma, it can be bought provided the

base is constructive.

9. Do not buy pocket pivots if the stock formed a 'V' where it sells off hard down through the 10-dma or

50-dma then shoots straight back up in a 'V' formation. Such formations are failure prone.

10. Avoid buying pocket pivots that occur after wedging patterns.

No comments:

Post a Comment