Tuesday, May 28, 2024

Monday, May 27, 2024

Leadership

Work on procedural memory to improve your trading

Procedural memory is memory about how to perform procedures.

How to trade momentum burst is procedural memory

How to trade episodic Pivots is procedural memory

How to sell into strength is procedural memory

How to trade anticipation setup is procedural memory

Adults have thousands of procedural memory. We perform these processes without thinking.

Adults have thousands of procedural memory. We perform these processes without thinking.

Driving a car is about procedural memory. We drive effortlessly without thinking. We are not even conscious of the process unless something happens.

Shaving, brushing your teeth, washing dishes, cooking, and many other things are stored in the brain as procedural memory where we can do them without thinking.

The day you realize trading success is about developing procedural memory specific to a setup or style of trading, you will be on the path to success. You will do things that will enhance procedural memory.

Trading success is about developing expertise. When you try and develop the expertise you train your procedural memory.

As a trader, you need to develop a setup-specific procedural memory. If you are trading 4% or $ b/o, you need to develop procedural memory specific to that setup.

Same way if you are going to trade anticipation setup and want to buy the first viable setup on a stock with momentum, you need to develop procedural memory about it.

Procedural memories are implicit memories. They allow us to lower our cognitive load. They are learned intuitions.

Procedural memory is memory about how to do a process. It is stored in memory as one schema.

A process containing say 32 steps is not stored in memory as 32 discrete step but as one sequence of step. When performing that task the brain efficiently recalls all those steps simultaneously so you can do the task effortlessly.

A process containing say 32 steps is not stored in memory as 32 discrete step but as one sequence of step. When performing that task the brain efficiently recalls all those steps simultaneously so you can do the task effortlessly.

Procedural memory helps free up the brain to do other things.

It frees the brain by reducing cognitive load. We have thousands of procedural memories developed over our lifetime. They make our life easy.

As a infant, we have very few procedural memories but we quickly build them as we grow and they become part of us.

For example, take a simple skill like swimming or brushing your teeth, it is a procedural memory once you develop it you can perform it without thinking or without focusing on a step-by-step sequence. But it takes us some time to develop.

The same is true of trading. If you read about trading or buy a trading manual you will not develop procedural memory. You develop trading-related procedural memory by doing actual trading. If you do a process thousands of time you develop procedural memory.

How many hours and tries are required to learn to swim or perform a dance or gymnastics It is the same for trading.

How many hours and tries are required to learn to swim or perform a dance or gymnastics It is the same for trading.

If your setup is fast setup requiring fast entry and exit like say day trade, then procedural memory is even more important. You have to perform the task at speed without thinking too much.

New traders spend too little time developing procedural memory.

Before they can develop procedural memory they switch to new ideas and setups.

One day they ride a bike for a few hours and struggle, the next day do a few hours of swimming and give up because water enters the nose and ear, the next day they try something new. In the process, they do not have procedural memory for setup.

Stick with a setup for six months to a year to become good at it.

Procedural memory also allows us to do a vast number of day-to-day tasks. Imagine if you had to learn to drive every day, or learn to walk every day. Life would be impossible without well-developed procedural memory.

The same thing happens in trading. As a trader, you develop hundreds of procedural memories to make your trading effortless.

Where to enter, where to exit, where to abandon a setup without waiting for stops to hit, and how to determine risk are all procedural memories developed through practice.

Finding anticipation setup is procedural memory. Once you develop it, you can quickly go through 400 to 500 stocks and identify those 5 to 6 good setups. No amount of instructions and manual can make you learn that skill unless you do it daily for say 90 to 100 days.

Most successful traders who survive the market for many years have developed procedural memories specific to a style of trading or a setup.

They can instinctively trade those setups without thinking about individual processes or steps involved in that setup. They are not conscious of the steps.

A novice watching them trade many times does not understand their decisions. Many times they get out of a trade just before it hits a pothole or avoid certain trades that novices will take.

A lot of it is instinct developed as a result of procedural memory development. It is like a driver instinctively hitting breaks at the sign of something on the road.

For discretionary trading, it is all about procedural memory development on a specific setup.

If your efforts at training procedural memory to trade a setup or style are successful then you will become efficient in trading that style.

Once you learn a setup it becomes relatively easy to develop procedural memory on a related style or setup.

But it is difficult to develop procedural memory on another instrument or style. That is why you will see many successful traders focus on a very narrow niche in the market.

Some focus on growth investing, some focus on value, some on options, some on futures, and some on currencies.

Within that, they focus on a very niche setup. Some trade growth stocks as swing trades, and some trade them as position trades. These two setups require distinct procedural memories.

Most successful traders learn by trial and error that sticking to their setup is best because when they do it the procedural memory automatically kicks in.

Novice traders are ambitious, they want to trade as many setups as possible. They don't want to miss out on any style or instrument-like option or futures. So they try and simultaneously develop procedural memory. That obviously leads to failure.

If we know that the key to discretionary trading success is procedural memory then why is it difficult to develop procedural memory?

To develop procedural memory you need a highly structured environment.

When you learn to drive, it is done in a structured environment. You learn it in a step-wise manner under close supervision. There is someone sitting next to you closely supervising every step and also ensuring you don't get killed.

Every month you will see some young kid getting killed in a car accident, and the reason is largely to do with a lack of well-developed procedural memory and bravado.

As against that much of learning to trade on your own is an unstructured and unsupervised process unless you join a trading firm or a Wall Street trading house or bank.

You are your own instructor and you need to create your own structure and you need to give yourself correct feedback and you need to ensure you do not get killed by blowing up your account. And more importantly, you need to persist for months in the learning stage still it becomes an effortless exercise.

If you want to develop trading procedural memory and make thousands or millions the first step is to put all your effort into developing procedural memory.

It is not about trying things once, it is about the 500th attempt and the thousandth and three thousandth attempt that makes you effortless. That is what develops procedural memory. You can not do it in 15 days.

If you read the classic Wall Street books like How I made 2 million dollars in the stock market by Darvas or Reminiscence of a Stock operator, you will see that much of the struggle depicted in those books is about trying to find a setup and a process and sticking to it.

Once Darvas found his setup and developed a process it was easy. In Livermore case, he went from setup to setup and from day trading to position trading before making big money.

It is the same thing that happens on the Stockbee site hundreds of novices join every year. Some give up in a few months, those persist for months, six months or a year at some stage develop procedural memory, and then develop their own setups.

Some still stick around, because they find the environment enriching and motivating. They like learning from others and continue to improve.

Some become very good at a particular style or time frame like day trading. They start their own site.

Some are scared of sharing their setup and secretive, they spend time talking in riddles. Some do not want to help others. But that is what makes the world interesting. Not everyone is motivated by helping others.

The Stockbee site fosters such an ecosystem and survives the process as new traders bring in new ideas and new energy. And some old traders here take on a mentorship role to guide newcomers.

As a novice trader if you understand the role of procedural memory in trading you would approach the task differently. You will set process goals against monetary goals.

You will focus on a well-developed setup idea with step-by-step instructions.

You will try and find someone to supervise your process and ensure you do not get killed during the earning process.

In most procedural memory development situations, an apprentice model has shown to be most effective for learning.

When you attempt to develop procedural memory on your own, unless you are extremely motivated and driven (or the correct word according to psychologists is you have very high self-efficacy beliefs) the task is difficult. That is why you will see few extremely motivated individuals make it in this field.

This is the reason most ordinary and less motivated traders fail before they can achieve profitability.

They blame markets or other things for it but in many cases, the fault lies with the failure to train procedural memory.

In order to develop procedural memory for any given time frame or style or set up first, you need to start with a well-defined setup with a clear step-by-step process led out with a clear explanation for each step.

For example, if you were to decide to trade a swing trade setup, you need a clear well-defined highly structured process that you can follow and master till you can do it on your own without supervision. That is why I and many other traders here repeatedly share processes, set up, and repeat things till people get it.

That is why this site puts so much focus on becoming process oriented.

Develop process flow and develop procedural memory. Once you do that you are on your own.

Friday, May 24, 2024

Thursday, May 23, 2024

FIVE PRINCIPLES OF VPA and Shooting Star by ANNA COULING

Principle Number One

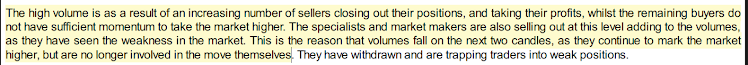

The length of any wick, either to the top or bottom of the candle is ALWAYS the first point of focus because it instantly reveals, impending strength,

weakness, and indecision, and more importantly, the extent of any associated market sentiment.

Principle Number Two

If no wick is created, then this signals strong market sentiment in the direction of the closing price.

Principle Number Three

A narrow body indicates weak market sentiment. A wide body represents strong market sentiment.

Principle Number Four

A candle of the same type will have a completely different meaning depending on where it appears in a price trend. Always reference the candle to the location within the broader trend, or in the consolidation phase.

Principle Number Five

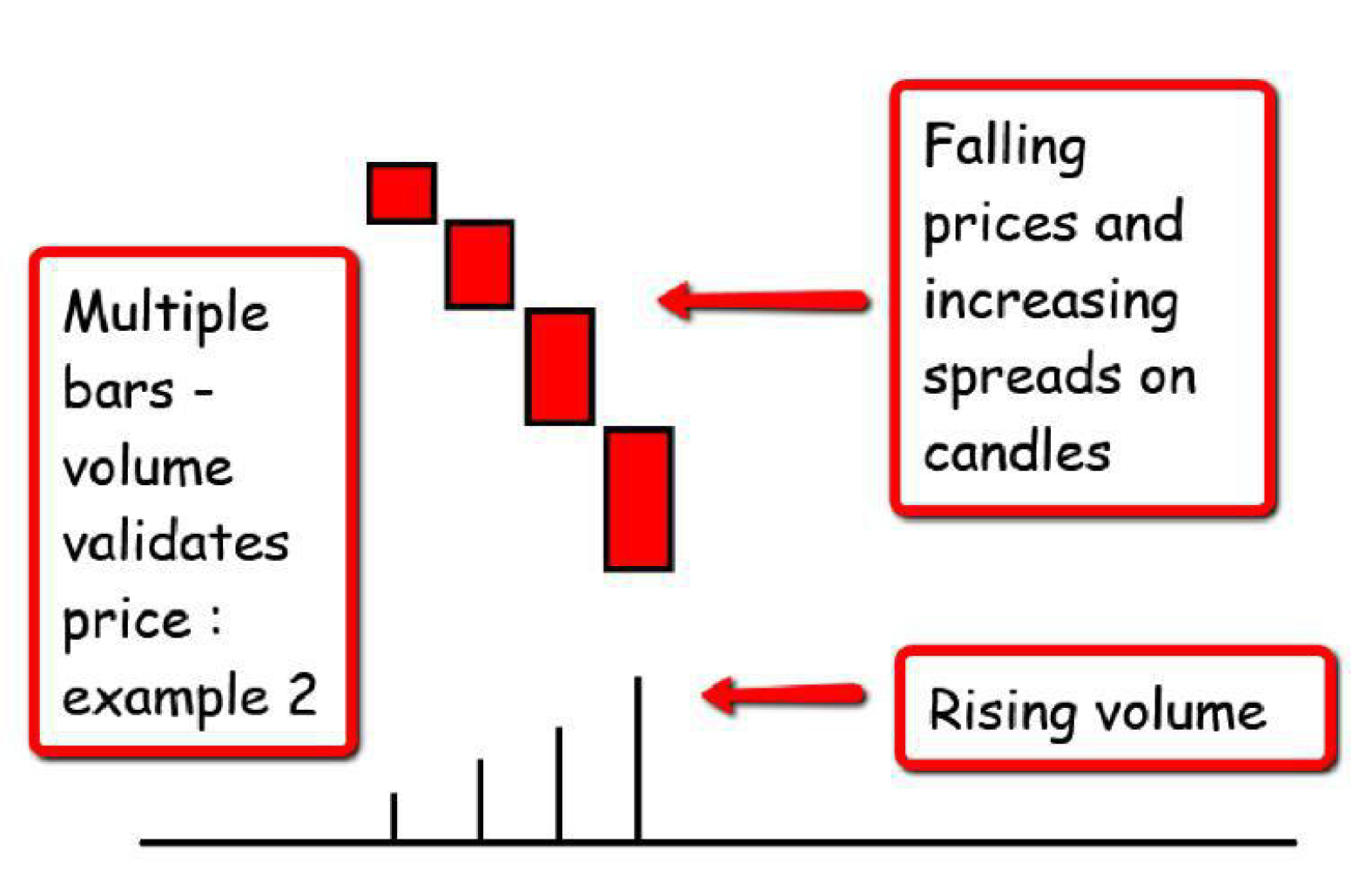

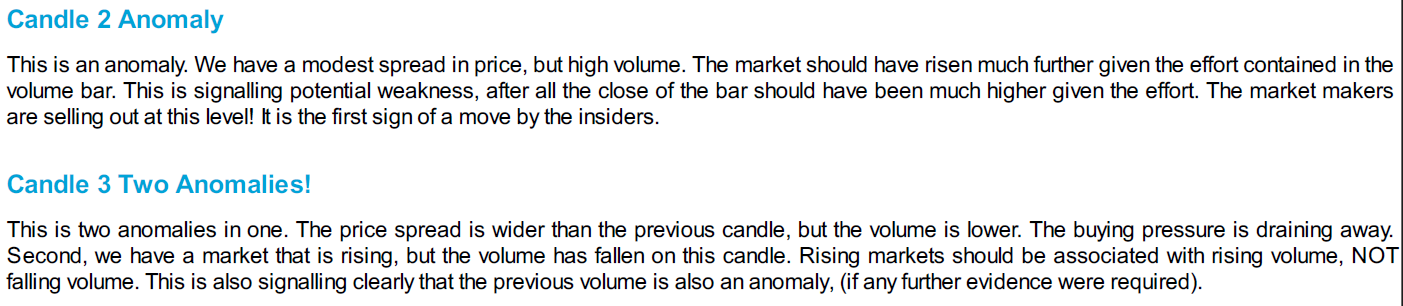

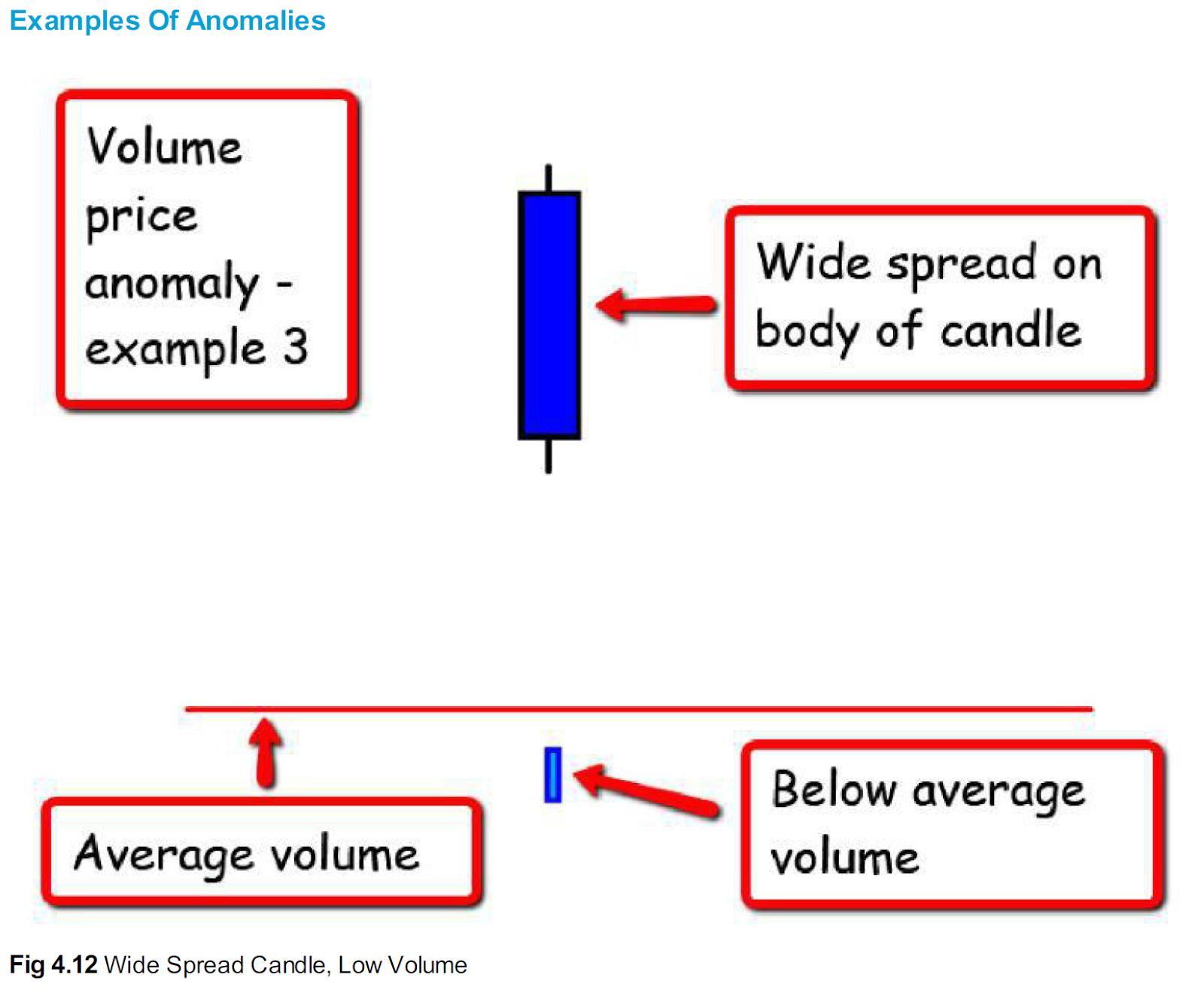

Volume validates price. Start with the candle, then look for validation or anomalies of the price action by the volume bar.

So, let me start with two of the most important candles, the shooting star and the hammer candle.

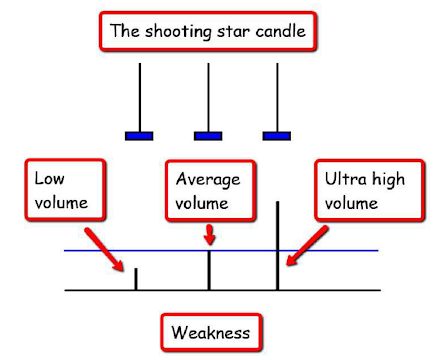

Shooting Star:

- Weakness

- Can only be understood with volume that is showing on that candle, in the corresponding timeframe

- if the volume on the second shooting star is higher than the first, so 'weakness' has increased as more selling is coming to the market and forcing prices lower in the session.

- In other words, single candles are important, multiple appearances of the same candle, in the same price area, exponentially increase the level of bearish or bullish sentiment

Accumulation Distribution Testing Selling and buying climax

Do we mean the insiders are free to simply move prices higher and lower at random and whenever it suits them to do so. The answer is NO. What I mean by market manipulation, which is perhaps different to other peoples view, is that this simply means using every available resource, to either trigger fear or greed in the retail traders mind. This means using every piece of news in the media to influence the buying and selling, and to move the market in the direction that the insiders require, either higher to a distribution phase, or lower to an accumulation range.

Tuesday, May 21, 2024

Monday, May 20, 2024

Sunday, May 19, 2024

Shakeouts

Get low risk setups rather than waiting for obvious lines

Bear Trap/Shakeout = breaks support, and then comes up

Shakeout and comes up with good volume / gap up

Prior support is entry point

3-3:15 pm scans

Price shakeout MA shakeout Pyramid - do not be greedy

Undercut and Rally

45 degree stocks with bounce frmo mas

strong stocks can be traded with 10 mas

univastu

Pocket Pivot

1. The percentage change of the candle on that day from open is greater than 3%.

2. The volume on the day of 3% candle is higher than the highest red volume in the past 10 days.

The second condition is based on the 'Pocket Pivot' concept developed by Gil Morales and Chris Kacher.

If only one of the conditions is met, while the other is not, there will be no arrow.

How to use the Pocket Pivot Breakout indicator?

1. If the stock is breaking out of a proper base like (cup & handle, Darvas box etc.), you can use the blue arrow as an indicator to make your initial buy.

2. If you already own a stock, the blue arrow indicator can be used for pyramiding, following a continuation breakout from a proper base.

3. Avoid making a new entry or continuation entry if the stock is too extended from 10ma.

Gap-up > 0.5% Indicator

Gap-up Indicator displays a blue colored candle when a stock gaps up by more than 0.5% compared to previous day's close.

It is turned off by default. To activate it, check the box next to Gap-up > 0.5% in the indicator options.

How to use the Gap-up Indicator?

1. When a stock gaps up, it usually indicates strength, especially if on the day of the gap-up, the stock closes strongly.

2. This indicator should not be used in isolation but with a proper base breakout from a tight consolidation.

3. If a stock is already extended from 10ma, avoid taking any new or continuation entries.

Precautions

1. Avoid buying longs when the general market conditions are not favorable.

2. Avoid buying stocks below 200ma.

3. Avoid making a new entry or pyramid entry if a stock is too extended from 10ma.

Important Points

1. Always choose fundamentally strong stocks showing strong growth in earnings/margins/sales.

2. Buy these fundamentally strong stocks when they are breaking out of proper bases.

3. To learn more about pocket pivots and buyable gap-ups, read the book, Trade Like an O'Neil Disciple (by Gil Morales & Chris Kacher).

Monday, May 13, 2024

PVAC

Two indicators: Price and Volume

-

Petrol: Electronics: Sugar: 35rs 41rs 62rs 74rs 62rs 70rs 69rs 64rs 69rs 48rs 53rs 37rs 28rs 55rs 88rs 69rs 52rs 66rs 86rs 84rs 59rs 78rs ...