Principle Number One

The length of any wick, either to the top or bottom of the candle is ALWAYS the first point of focus because it instantly reveals, impending strength,

weakness, and indecision, and more importantly, the extent of any associated market sentiment.

Principle Number Two

If no wick is created, then this signals strong market sentiment in the direction of the closing price.

Principle Number Three

A narrow body indicates weak market sentiment. A wide body represents strong market sentiment.

Principle Number Four

A candle of the same type will have a completely different meaning depending on where it appears in a price trend. Always reference the candle to the location within the broader trend, or in the consolidation phase.

Principle Number Five

Volume validates price. Start with the candle, then look for validation or anomalies of the price action by the volume bar.

So, let me start with two of the most important candles, the shooting star and the hammer candle.

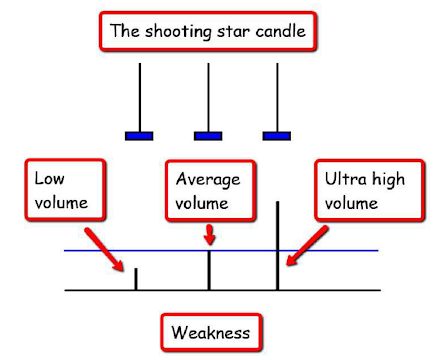

Shooting Star:

- Weakness

- Can only be understood with volume that is showing on that candle, in the corresponding timeframe

- if the volume on the second shooting star is higher than the first, so 'weakness' has increased as more selling is coming to the market and forcing prices lower in the session.

- In other words, single candles are important, multiple appearances of the same candle, in the same price area, exponentially increase the level of bearish or bullish sentiment

No comments:

Post a Comment